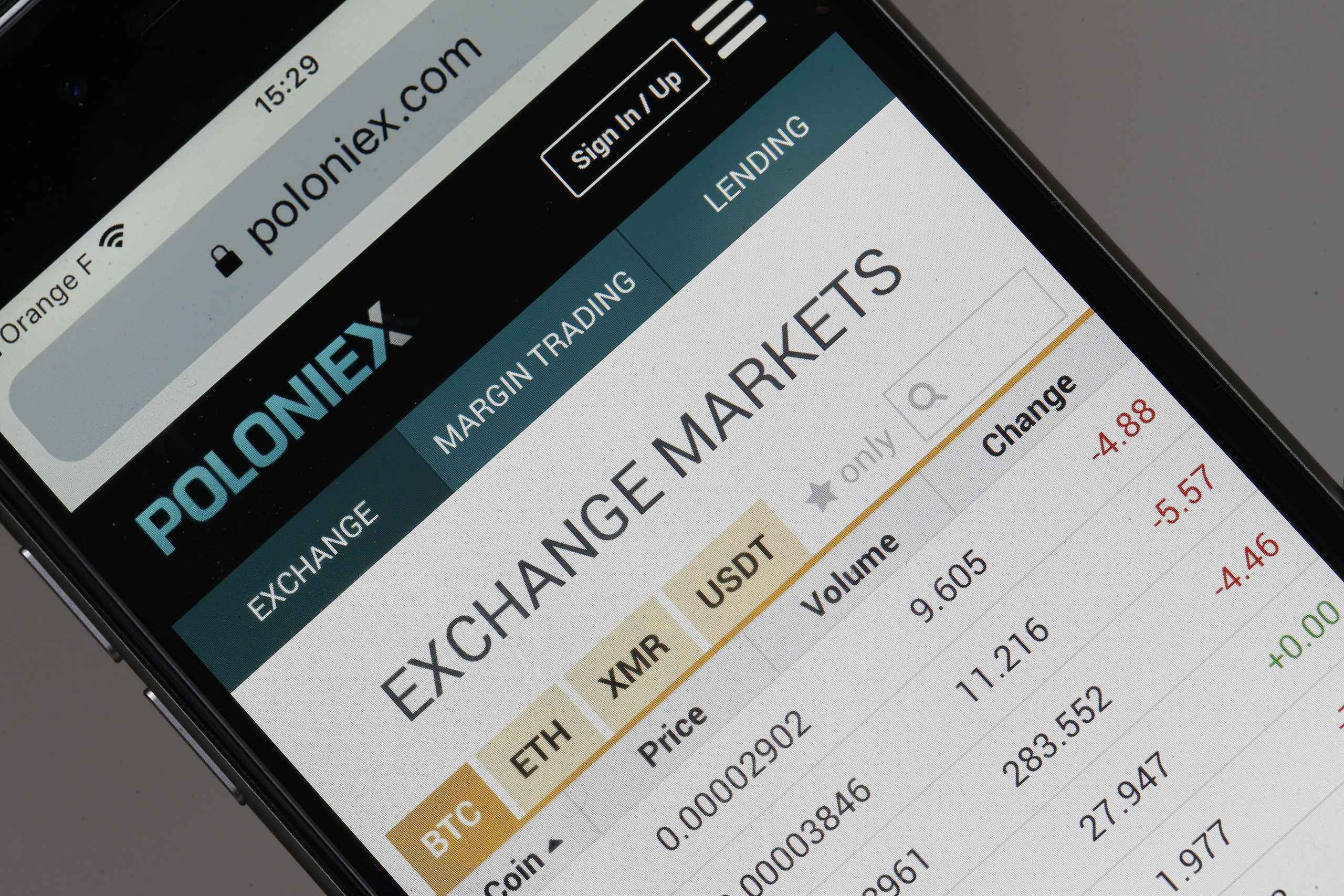

Poloniex is a cryptocurrency trading exchange that was established during the cryptocurrency boom of 2014. It is a platform that allows users to buy and sell digital currency assets. The exchange is free to use and allows you to create a personal account to start trading on the platform. It is a great place to trade cryptocurrencies as it offers low fees for any volume. The exchange also has a variety of features such as margin trading and faster resolutions for customer service issues.

Poloniex is one of the oldest cryptocurrency exchanges, and as such, has a massive selection of coins that can be traded. Their fee structure is very reasonable, with the highest tier only costing 0.155%. This makes Poloniex an attractive exchange for any high-volume trader. Poloniex is available globally and can be accessed by anyone with an internet connection. Poloniex also has a number of accounts for large traders, professional traders and institutions that provide lower trading fees, premium features and an account manager standing by to ensure impeccable customer service. These Poloniex Plus silver and gold accounts are perfect for high-volume traders that want a more robust exchange experience.

For those who want to be more hands-off, there are several options to help you automate your trading on the Poloniex crypto exchange. You can either purchase or build your own bot using a Python programming language. Then, you can link it to your account and set up a schedule for it to execute trades on the Poloniex platform. Alternatively, you can simply copy someone else’s strategy on the Poloniex marketplace. This method is called copy trading, and it works by paying a percentage of your winnings to the trader who posted the strategy.

Another option for automated Poloniex trading is a software program called Gunbot, which is an open source program that can be used on Windows and Mac computers. It is easy to install and has a variety of configuration options that allow you to customize the trading system to fit your needs. The software also has a user-friendly interface and provides detailed logs and backups to keep you safe.

Monitoring and managing your automated trades is a crucial aspect of successful cryptocurrency trading with a bot. While automation can streamline your trading activities, it doesn’t mean you can simply set it and forget it. Vigilance and periodic oversight are essential to ensure your bot performs optimally and aligns with your trading objectives.

Real-time tracking of bot performance is fundamental. Most trading bots, including those compatible with Poloniex, offer comprehensive dashboards that display vital metrics like profit/loss, trade volume, and success rates. Regularly monitoring these metrics empowers you to spot any anomalies or underperforming strategies promptly.

Analyzing trading results is equally vital for continuous improvement. By reviewing past trades and identifying patterns, you can assess the effectiveness of your chosen strategies and make informed adjustments. Backtesting your bot against historical data can validate its performance and help refine your approach.

Risk management is paramount in automated trading. Implementing stop-loss and take-profit orders safeguards your portfolio from significant losses and ensures you capitalize on profitable opportunities. Regularly reassess your risk tolerance and adjust your bot’s configuration accordingly.

Stay informed about market trends and news to adapt to evolving market conditions. Cryptocurrency markets are highly dynamic, and unexpected events can impact your automated trades. Keeping abreast of the latest developments allows you to respond proactively.

Best Practices and Tips for Poloniex Bot Trading

Diversification of Strategies and Assets

Diversifying your trading strategies is essential to mitigate risks and achieve consistent returns. Avoid relying solely on one trading approach, as market conditions can change rapidly. Consider combining various strategies such as market-making, trend-following, and arbitrage to create a robust trading portfolio. Additionally, diversify the cryptocurrencies you trade to spread risk across different assets.

Regularly Updating and Optimizing the Bot

Keeping your trading bot up to date is crucial for optimal performance. Most bot providers release regular updates that may include bug fixes, security enhancements, and new features. Failure to update your bot could lead to inefficiencies or even vulnerabilities. Additionally, periodically optimize your trading bot’s settings and parameters based on historical performance and market conditions to ensure it aligns with current trends.

Staying Informed about Market Trends and News

Cryptocurrency markets are influenced by various factors, including regulatory news, technological advancements, and macroeconomic events. Stay informed about industry developments, market trends, and relevant news to adapt your trading strategy accordingly. Social media platforms, cryptocurrency news websites, and reputable financial news sources are valuable resources for staying updated.

Implementing Proper Risk Management

Risk management is fundamental to successful bot trading. Define your risk tolerance and implement appropriate risk management tools such as stop-loss and take-profit orders. These features protect your investment from significant losses and secure profits when favorable conditions arise. Avoid over-leveraging your trades and always trade with a capital you can afford to lose.

Monitoring and Adjusting Performance

Regularly monitor your bot’s performance metrics and analyze its trading results. Identify patterns and trends to understand which strategies are working well and which need improvement. Be prepared to make necessary adjustments to your bot’s configuration based on data-driven insights.

Top Bots for Poloniex: Choosing the Best Crypto Trading Bots

For those aiming to maximize efficiency on Poloniex, choosing the right trading bot is key. A range of options can help you tailor your trading approach, but selecting the best crypto trading bots can simplify the process. Explore our top recommendations here to discover tools specifically built to streamline complex trading strategies, whether you’re a beginner or an experienced trader looking for advanced automation features.

There are many Poloniex trading bot out there, but not all of them are created equal. Some are simple to use, while others are more complex and can be difficult for novices to learn. Some are even built with a particular purpose in mind, such as generating passive income through automated trading. For example, a bot that can scan and analyze thousands of portfolios to identify profitable combinations is Holderlab, which is a highly effective tool for Poloniex users. It can also rebalance, optimize, and analyze your portfolios to maximize your profits. It is also compatible with a multitude of other exchanges, making it a powerful and valuable asset for any seasoned cryptocurrency investor.