Decentralized finance is disrupting traditional finance at an astronomical and hastening rate. Yet, things could be moving even faster if there was a proper interface that was easy to access and use.

Simplicity is what traditional finance still has against the emerging blockchain industry, but that’s all changing as more specialized developers begin building out their products and services on top of foundational blockchain layers like Ethereum and others.

The result is companies like PrimeXBT and Covesting coming together to build a new platform that could finally cause DeFi adoption to catch up with the booming interest that’s brewing in the crypto community and elsewhere. By breaking down the barriers to entering some of DeFi’s top APY-generating protocols, PrimeXBT and Covesting together could change the face of crypto – and finance – forever.

What Is DeFi?

DeFi, short for decentralized finance, is a blossoming sub-sector of the crypto and blockchain market that’s giving traditional finance a run for their seemingly endless supply of money. Amidst rising inflation, interest rates on conventional savings accounts are offering next to nothing for returns. APY rates are as low as 0.04% globally – what’s even the point?

Factoring in soaring inflation, the money in a savings account is actually losing a tremendous amount of buying power over time. But with DeFi, rates can range from 1% to as much as 10-20% or more in rare cases. APYs are variable in DeFi, so be sure to check often to see what the highest rates are no matter the platform or application being used.

DeFi users can access permissionless lending and borrowing, as well as yield-generating products by staking assets or locking them up in liquidity pools. However, DeFi can be technically challenging as we’ll explain further.

Using Uniswap as an example, users of the platform must pool capital together to provide enough liquidity for active trading across various trading pairs, such as ETH/COV. Liquidity providers must provision their assets by locking them up.

For their efforts and their capital, they earn themselves a variable ROI called an annual percentage yield, or APY for short. The problem is that it requires time and understanding of the blockchain, and the ability to connect to wallets on whichever blockchain the user seeks to interact with.

If that all sounds too confusing or complicated, you aren’t alone, and these challenges are the biggest barriers to widespread adoption of DeFi products like staking, and other services.

What Is Staking?

Staking, as noted, involves locking up idle crypto assets and generating an APY in return. With more common cryptocurrency exchanges, liquidity is offered to customers from the exchange providers themselves. However, with decentralized protocols and automated market-making platforms, the only way for liquidity to be viable is for users to provide it themselves.

Trading pairs are offered as “liquidity pools,” and token holders on both sides of the pair can pool liquidity by staking tokens. In return for locking up tokens, these users are distributed crypto rewards from the fees generated by trading on the platform.

Because of the demand in crypto and the surge in trading volume, there’s plenty of liquidity, and that means rates can be astounding. As mentioned, savings accounts are barely 0.04%, while APYs in DeFi are dozens of times that.

However, even more interesting is a new staking product coming that, right out of the gate, is offering a 1% APY bonus to those who join an early bird waitlist. That means that the intro boost alone that users can access is several times more profitable than the returns that banks offer on massive deposits.

What Are Covesting Yield Accounts?

Covesting Yield Accounts are the key to unlocking the full potential of the DeFi space. PrimeXBT has partnered with European fintech developer Covesting for several innovative experiences, including the Covesting copy trading module – now this.

The all new Covesting Yield Account service connects users to top DeFi protocols to generate industry best APY for all.

Rather than having to know DeFi inside and out, spend hours connecting wallets and whatnot, users can instead, in a few clicks, access Covesting Yield Accounts and get a taste of the best rates DeFi has to offer. Covesting Yield Account APY reaches as high as 35% when combined with COV token staking.

Beyond profitability, power and simplicity is the theme of anything the two companies produce together. And at the center of it all is always the COV utility token. The COV token itself is essential to the Covesting ecosystem of products providing token holders with an expansive universe of benefits and account level enhancements.

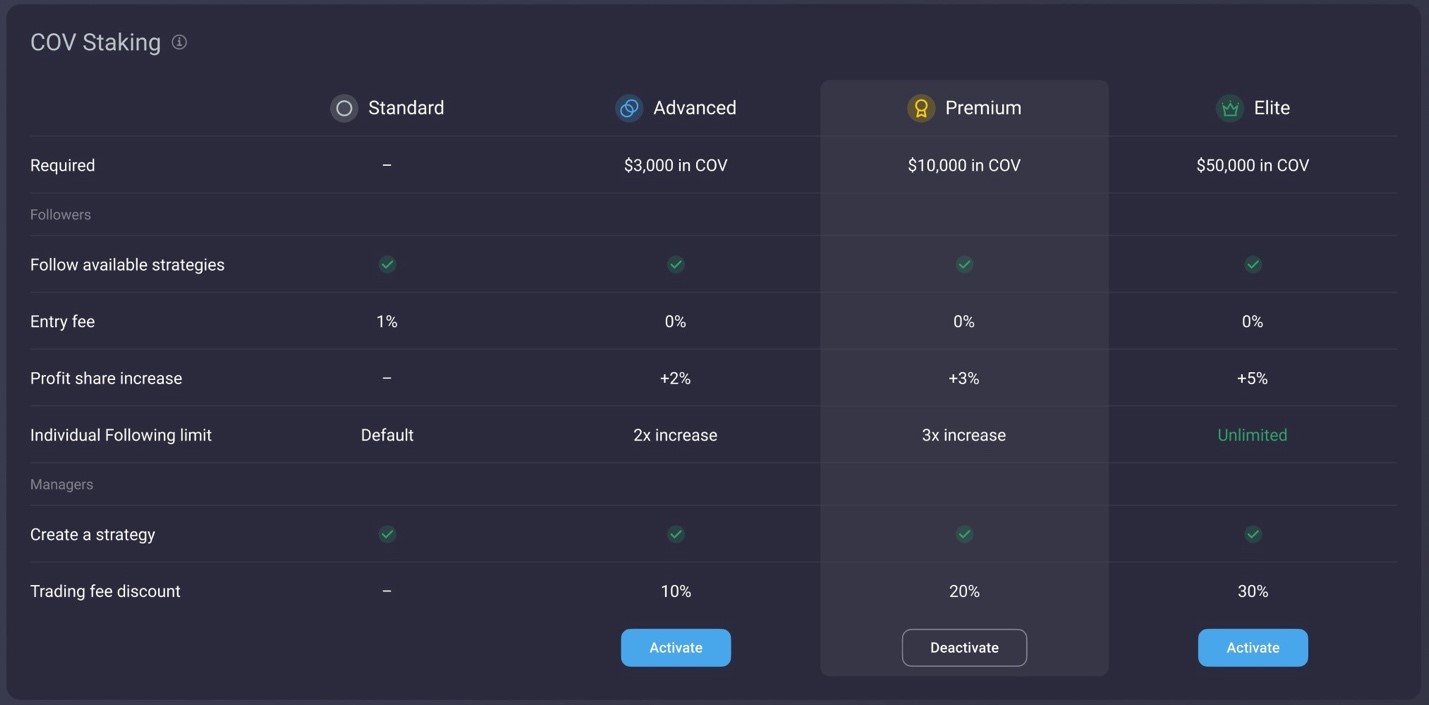

New COV staking accounts allow up to three different membership levels, with exclusive benefits that get better and better with each tier and more COV tokens staked. Tiers start with staking free Standard accounts, but with COV token staking can be upgraded to Advanced, Premium, and Elite. COV token staking also gives the entire Covesting Yield Account module up to a 2x boost on APY generated from the platform.

This incredible boost can be enhanced further for a short time by stacking on the 1% boost that early birds get by joining the waitlist. Other COV token staking benefits include the full removal of entry fees for new followings, a profit share increase in favor of the follower of up to 5%, up to an unlimited increase in followers for strategies, and a reduction in trading fees for strategy managers

All of this is on top of the best APY rates the industry has to offer, provided through a user-friendly experience that anyone in the world regardless of any skill level can utilize.

How PrimeXBT And Covesting Will Make Defi Easy

Covesting and PrimeXBT have once again built an easy to use, simple-to-access user interface that is appealing to both novices and professionals. Those who want a deep experience have everything they need at their disposal from CFD trading, long and short positions, copy trading, and much more.

With the addition of DeFi products and yield-generating accounts on PrimeXBT from Covesting, all enhanced by the power of the COV token, getting into DeFi has never been easier or more efficient.